Nvidia Hits $4 Trillion – The Rise of AI’s Powerhouse

In a groundbreaking moment for the global tech industry, Nvidia (NASDAQ: NVDA) has officially become the first publicly traded company in history to reach a $4 trillion market capitalization. This milestone, achieved on July 9, 2025, marks more than just a number — it symbolizes Nvidia’s unmatched dominance in the AI revolution and its central role in building the digital future.

From $1 Trillion to $4 Trillion in Just Two Years

In June 2023, Nvidia crossed the $1 trillion valuation milestone. Fast forward just two years, and the company has quadrupled that value — outpacing tech titans like Apple and Microsoft.

The secret behind this explosive growth? A massive global demand for high-performance GPUs used in training and running artificial intelligence systems — from large language models to self-driving cars and enterprise data centers.

The Vision of Jensen Huang

At the core of Nvidia’s success is Jensen Huang, co-founder and CEO. Huang didn’t just build powerful chips for gamers — he foresaw the transformative potential of GPUs in data science, AI, and machine learning.

Nvidia’s breakthrough came with CUDA, a proprietary parallel computing platform that transformed GPUs from graphics engines into the heart of AI infrastructure. CUDA allowed developers to build AI models, simulations, and scientific computing projects with unprecedented performance — all on Nvidia’s platform.

This strategic investment positioned Nvidia ahead of the AI curve years before the deep learning boom truly began.

Powering the AI Economy

Today, Nvidia powers the world’s most advanced AI workloads. Over 80% of the global AI GPU market is controlled by Nvidia. Its chips are deployed by leading tech giants like:

- Microsoft (Azure AI infrastructure)

- Amazon Web Services (Trainium & Nvidia-powered EC2 instances)

- Google Cloud (AI & machine learning accelerators)

- Meta Platforms (LLMs and metaverse infrastructure)

Upcoming chip architectures like Hopper and Blackwell are already in high demand, with massive pre-orders from hyperscalers and AI startups alike.

Global Economic Impact

Nvidia’s $4 trillion valuation now surpasses the entire stock markets of countries like the United Kingdom, Canada, and Mexico. It has also overtaken Apple and Microsoft as the top weight in the S&P 500 Index, reshaping Wall Street’s AI investment strategy.

This shift signifies a larger trend: AI is no longer a niche — it’s the foundation of the modern digital economy.

What Lies Ahead for Nvidia?

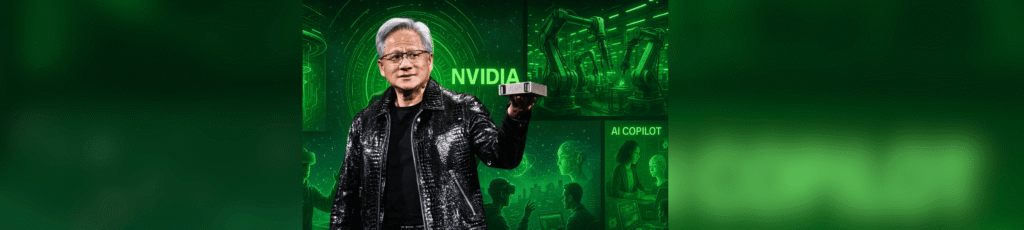

Despite this historic achievement, Nvidia is far from slowing down. The company continues to invest heavily in:

- Robotics and autonomous systems

- Quantum computing research

- AI for enterprise productivity (AI copilots)

- Next-gen simulation and digital twins (Omniverse)

Jensen Huang envisions a world where AI helps humans become “superhuman” — enhancing productivity, creativity, and problem-solving across every sector.

Challenges and Competitive Pressure

Nvidia’s path isn’t without hurdles. Key challenges include:

- US restrictions on exporting advanced chips to China, which could cost billions in lost revenue.

- Growing competition from AMD and custom AI chips developed internally by Amazon, Google, and Microsoft.

Still, Nvidia holds a significant edge thanks to its combination of world-class hardware, the mature CUDA software ecosystem, and deep partnerships across industries.

Final Thoughts

Nvidia’s $4 trillion market cap isn’t just a financial milestone — it’s a testament to how AI is reshaping the world. From powering generative AI like ChatGPT to transforming industries like healthcare and robotics, Nvidia is at the center of it all.

As the AI era accelerates, one thing is clear: Nvidia isn’t just participating in the future — it’s building it.

This is Power of Idea Startup From Dishwasher to $ 4 Trillion Market Cap